After watching almost every single .eth backed loan I’ve made intentionally default, I have come to the initial conclusion these “borrowers” were never really borrowers at all. They were sellers, sellers who were happy to sell their collateral for eth and walk away without any thought to what happened afterwards.

After watching almost every single .eth backed loan I’ve made intentionally default, I have come to the initial conclusion these “borrowers” were never really borrowers at all. They were sellers, sellers who were happy to sell their collateral for eth and walk away without any thought to what happened afterwards.

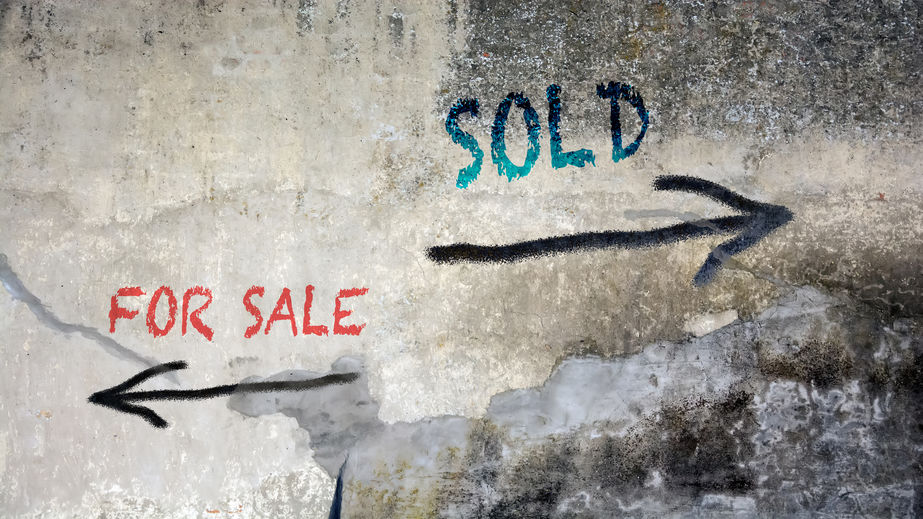

First off, the loans are not absolutely repayable. If the borrower doesn’t pay, the collateral is acquired by the lender and that’s the end of it. It’s a trade, an exchange, with one caveat I suppose. The seller can change their mind for a pre-determined amount of time and reverse the transaction but pay an interest rate for the time they spent thinking about it, which is actually kind of cool in its own right.

But it’s not all bad news for the lending business. What’s happening is that we are in a period where .eth owners have stopped believing or never actually believed in the value of their own assets. They are not using them to generate revenue, just holding them for sale and then panic selling them as the expiration date comes near (or panic borrowing against them which they consider a sale anyway).

.eth as a discoverable landing page or website is not a concept that has been received with any serious merit. Zero consideration is being given to web search. And so long as sellers of the names are convinced that there is no utility or value to a .eth beyond “the flex” they will probably give their names up pretty easily and for a very low price.