I just made my first NFT loan. I did it through Teller, a young NFT lending platform. I connected my wallet to the site and was able to browse a very limited number of potential borrowers seeking liquidity. Most were asking for more than I was willing to experiment with on a first try and all of them were offering to use a .eth-based ENS name as their collateral.

If none of them seem right, lenders can make unsolicited offers on just about any ENS name there is, whether those names belong to people who know about Teller or not. Any time an offer is made, Teller has a bot that tweets it out so maybe that’s how word of the offer would spread. That’s basically what I did.

Somewhat jokingly, I made an unsolicited offer on makerlee.eth, a name that belongs to Teller’s content/marketing manger known as @0xMakerlee on twitter. Making an unsolicited offer is expensive. It cost me about $10 in gas at the time so it is not currently feasible to make a lot of unsolicited bids that people might not even see or with terms they might not accept. After making the offer, I went to bed and forgot about it.

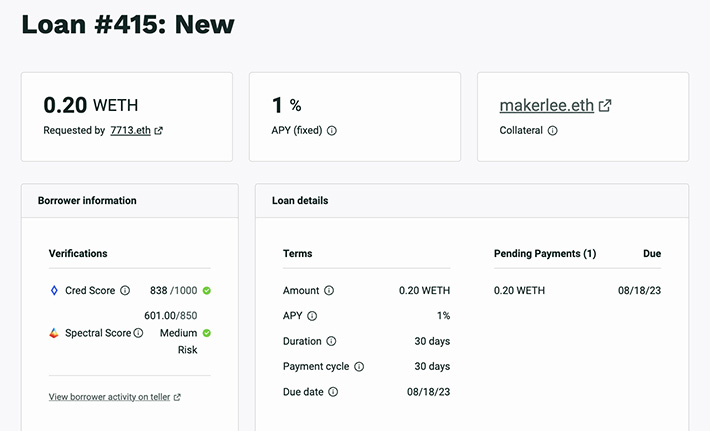

Today, I learned that @0xMakerlee had accepted it from the Teller tweet bot. It’s a small loan, only for .2 weth. Presumably it was accepted as a way to bring awareness to Teller. I had talked to @0xMakerlee previously about the platform and he is aware of my background with deBanked. Nevertheless, we had not discussed doing a loan between each other and yet here we are now. I am thankful for the opportunity to try this out. An NFT as collateral is incredibly risky, but I suppose it depends on what the NFT is.

The terms are as follows:

30 day loan

1% APY

Will it be a money-maker for me? No. But it’s good to learn. There also appears to be a 5 day grace period on the loan before the collateral is liquidated. If @0xMakerLee doesn’t pay, I would end up with his .eth name. Although one might wonder why such a thing would have any value at all, it could confuse people who previously associated the name with him to suddenly be in someone else’s possession. It’s a wallet address so it’s kind of dangerous to let go of! Obviously, I would have to sell it to recoup my loss or I could negotiate a second separate deal to give him the opportunity to buy it back. It all depends. As I’m not personally into flipping NFTs, I would prefer not to have to deal with the headache of selling the collateral.

Teller also provides some other info about the terms, such that they’ve assigned the borrower a proprietary “Cred Score” of 838/1000 and “Spectral Score” of 601.00/850. I didn’t look to see what they mean and will not put much weight on them for now.

I intend to conduct a few more experiments as well, with Teller, and hopefully on some other platforms too.